The GBP/USD currency pair continued to trade lower on Monday, despite the lack of any strong fundamental reasons for such a move. Of course, one can always find or even invent justifications, but there's no guarantee that market participants were buying dollars or selling pounds for those particular reasons. Let's unpack the situation.

On Monday, it was announced that Donald Trump had raised tariffs to 30% for the European Union and Mexico, and that the U.S. budget had shown a monthly surplus for the first time in eight years. Naturally, this was made possible solely thanks to Trump's tariffs. American importers paid a massive sum into the U.S. budget — a cost that will now be passed on to American consumers. But just how significant is this amount?

Let's recall that the vast majority of companies and businesses were thoroughly prepared for the trade war. What did that mean in practice? It meant stockpiling large inventories. In simple terms, before Trump imposed tariffs on half the world, American importers stocked up aggressively. And for several months now, they've simply been selling off those old inventories, which allows them to maintain pre-tariff pricing levels. Of course, that doesn't mean U.S. imports have been zero in recent months. However, imports have been below normal levels (which partly explains the improved trade balance), and they are likely to surge once business inventories are depleted. That's why we have not yet seen a rise in inflation or a decline in demand for foreign goods. U.S. businesses have absorbed the initial tariff shock. But in the future, businesses won't be able to shoulder these extra costs indefinitely. This means prices will rise, demand will fall, and imports will decline — along with tariff revenues.

As Jerome Powell has said many times, we can only assess the impact of tariffs on the economy once their final form is clear and after several months have passed to allow the economy to adapt. That is, at this stage, there's no point in making definitive conclusions about the effects of the new U.S. trade policy. Yes, the trade balance has indeed improved recently — but no one yet knows how much the U.S. economy will contract in Q2 and Q3, or how high inflation will rise by year-end. "You don't count your chickens before they hatch," and it seems we'll be doing that in the fall.

As before, we see no reason to panic about the recent sharp strengthening of the U.S. dollar over the past two weeks. A look at the daily time frame quickly shows that this correction is not particularly strong. The dollar has gained 300 points after falling 1,700. During that decline, it previously posted corrections of 300 points as well. We still see no fundamental basis for dollar strength. Therefore, we expect the current correction to end and for the market to begin pricing in Trump's new trade measures through dollar selling.

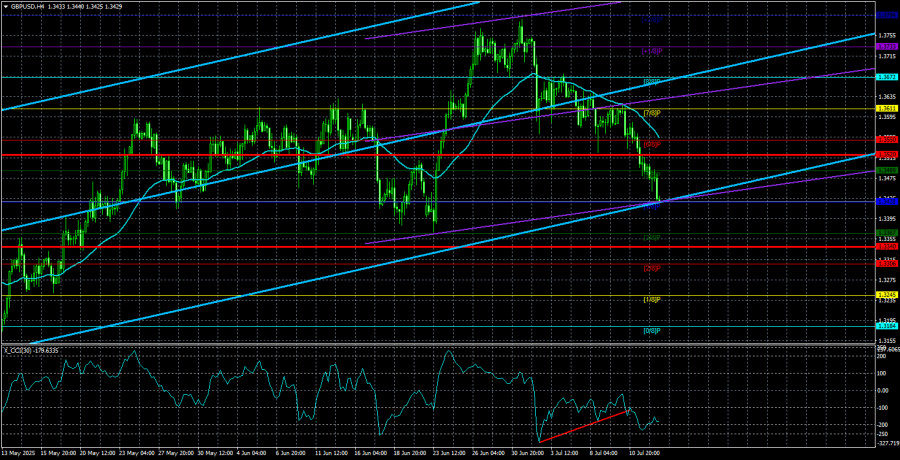

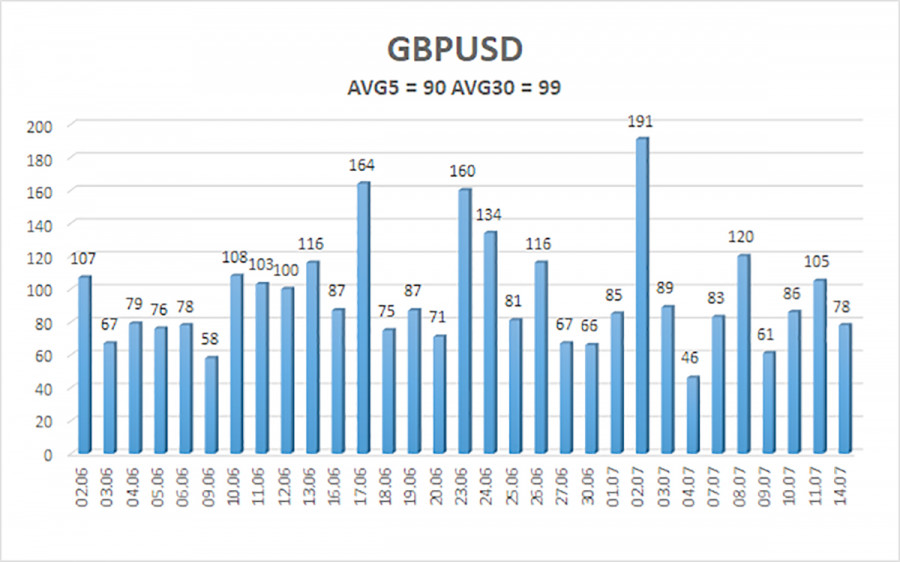

The average volatility of the GBP/USD pair over the last five trading days is 90 points, which is considered "moderate" for the pound/dollar pair. Thus, on Tuesday, July 15, we expect the pair to move within a range defined by the 1.3340 to 1.3520 levels. The long-term regression channel is still pointing upward, indicating a clear uptrend. The CCI indicator entered the oversold zone twice, signaling a potential resumption of the uptrend.

Nearest Support Levels:

S1 – 1.3428

S2 – 1.3367

S3 – 1.3306

Nearest Resistance Levels:

R1 – 1.3489

R2 – 1.3550

R3 – 1.3611

Trading Recommendations:

The GBP/USD currency pair continues its downward correction, which may soon come to an end. In the medium term, Trump's policy is likely to continue putting pressure on the dollar. Therefore, long positions with targets at 1.3611 and 1.3672 remain valid if the price consolidates above the moving average.

If the price is below the moving average, short positions with targets at 1.3367 and 1.3340 may be considered. However, as before, we do not expect strong dollar growth. From time to time, the U.S. currency may see technical corrections, but for a sustained uptrend, it would need clear signs that the global trade war is truly over.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.