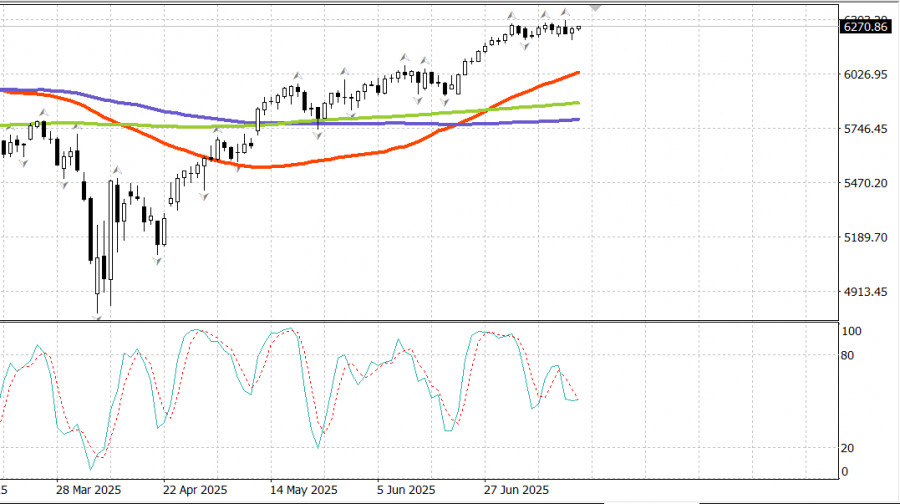

S&P500

Snapshot of major US stock indices on Wednesday

- Dow +0.5%,

- NASDAQ +0.3%,

- S&P 500 +0.3%, S&P 500 closed at 6263, trading in a range of 5,900 to 6400.

The stock market traded steadily following corporate reports from several major banks and a moderate June Producer Price Index (PPI), despite some overall volatility. PPI and core PPI for June were unchanged month-over-month, and both declined on a year-over-year basis compared to May.

Interest rates fell in response to the optimistic data, which impacts the core Personal Consumption Expenditures (PCE) index — the Fed's preferred inflation gauge. The yield on the 10-year Treasury note dropped five basis points to 4.44%.

A volatile moment occurred late in the morning session as reports surfaced that President Trump may be planning to fire Fed Chair Jerome Powell. In an interview from the Oval Office shortly after headlines broke, Trump stated he wasn't ruling anything out but considered it highly unlikely that Powell would be removed unless fraud were discovered.

The financial sector (+0.7%) posted early gains, supported by strong earnings from major banks for the second consecutive day.

Goldman Sachs (GS 708.82, +6.31, +0.9%), Morgan Stanley (MS 139.79, -1.80, -1.3%), and Bank of America (BAC 46.03, -0.12, -0.26%) all exceeded expectations for earnings per share (EPS). The weakness in stocks after reports was mainly due to profit-taking following an impressive rally, a trend that seemed to continue from the previous session.

The information technology sector (+0.3%) lagged early in the session, affected by ASML (ASML 754.45, -68.57, -8.33%), which beat Q2 earnings expectations but said it could not confirm growth in FY2026. The sector recovered during the session, though chipmaker stocks remained under pressure, with the PHLX Semiconductor Index closing down 0.4%.

For much of the session, only the health care (+1.2%) and real estate (+1.1%) sectors traded solidly in the green.

The health care sector got an extra boost from Johnson & Johnson (JNJ 164.77, +9.60, +6.2%), which reported strong Q2 earnings and revenue and raised its forecast for FY2025.

The President's clarification that Powell's dismissal is highly unlikely helped stabilize stocks following earlier volatility. Broad-based support allowed major indexes to close just below session highs. Eight of the eleven S&P 500 sectors ended the day in positive territory.

Support was seen across all market caps, but small-cap stocks notably outperformed, with the Russell 2000 rising 1.0%. The market-cap-weighted S&P 500 (+0.3%) ended the day in line with the equal-weighted S&P 500 (+0.4%).

US Treasuries experienced a volatile session, swinging between inflation optimism following the muted June PPI data and inflation concerns driven by speculation over Powell's potential departure. The yield on the 2-year Treasury fell seven basis points to 3.89%, while the 10-year yield fell three basis points to 4.46%.

Year-to-date performance

- S&P 500: +6.5%

- DJIA: +4.0%

- S&P 400: +0.6%

- Russell 2000: -0.1%

Economic calendar on Wednesday

The June final demand PPI was unchanged from the previous month (consensus: +0.2%), following a revised +0.3% gain in May (originally +0.1%). Core PPI (excluding food and energy) was also flat (consensus: +0.2%), following a revised +0.4% increase in May (originally +0.1%).

On a year-over-year basis, headline PPI rose 2.3% in June, down from 2.7% in May, while core PPI rose 2.6%, down from 3.2% in May.

The key takeaway is disinflation — observed both month-over-month and year-over-year — which aligns with the Fed's preferred direction. These steady June readings also set expectations for the upcoming PCE inflation report.

Industrial production rose 0.3% MoM in June (consensus: +0.1%), after a revised flat reading for May (from -0.2%).

Capacity utilization was 77.6% (consensus: 77.4%) versus a revised 77.5% in May (from 77.4%). Total industrial production increased 0.7% YoY, while capacity utilization remained 2.0 percentage points below the long-term average.

The main takeaway is that June's jump in industrial production was driven primarily by a surge in utilities output — typically influenced by weather — while manufacturing output rose modestly by 0.1% despite more favorable tariff conditions.

Energy market

Brent crude is now trading at $68.40.

Conclusion The US stock market has been range-bound since July 3, roughly for two weeks. From a technical analysis viewpoint, this flat consolidation just below recent highs likely signals an imminent breakout and a new upward leg. A more aggressive approach would be to buy in anticipation of a breakout. A conservative strategy would be to wait for a proper pullback to support on the S&P 500 before entering.