GBP/USD Analysis on 5M

On Thursday, the GBP/USD currency pair continued its downward movement throughout the day, following British data that significantly disappointed and the end of the US government shutdown. If anyone is unclear about these events, the end of the shutdown is a positive event for the dollar and should have prompted an appreciation of the US currency (i.e., a decline in the pair). However, weak (below-expected) GDP growth and a contraction in UK industrial production are negative factors that should have weighed on the British pound (i.e., a decline in the pair). In fact, we observed the exact opposite movement, which intensified sharply.

As we've noted in recent weeks, the fundamental and macroeconomic background has little in common with the pair's market movements. For a month and a half, the dollar rose, using any formal excuse for it. When real reasons for the US currency's appreciation finally appeared, it began to fall. This is because a global upward trend remains intact, and all movements we have observed over the past months are merely technical corrections. Even with the pound exiting its sideways channel on the daily timeframe, the upward trend has not been canceled.

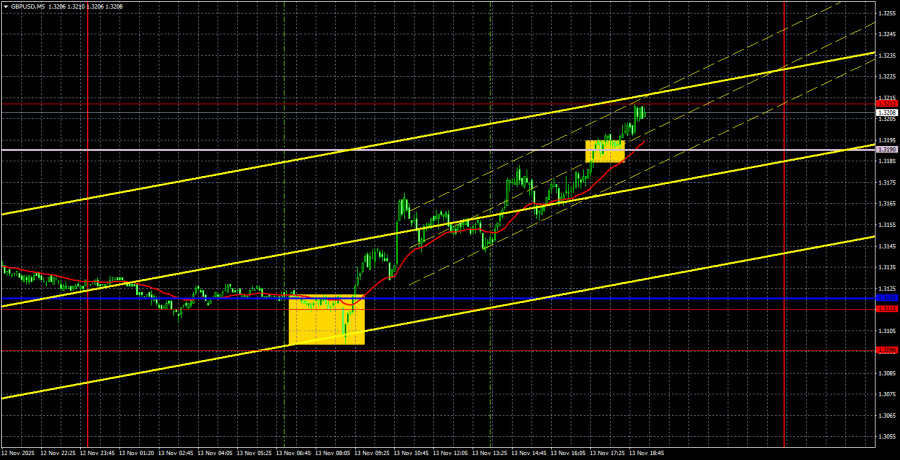

On the 5-minute timeframe, an excellent buy signal was formed at the very beginning of the European trading session yesterday. The price rebounded from the area of 1.3096-1.3115 and from the Kijun-sen line, and by the end of the day, it traded above the Senkou Span B line and reached 1.3212. Thus, traders could earn approximately 60-80 pips with minimal effort by opening a series of trades. The trend line has been broken, and the Senkou Span B line has been surpassed on the hourly timeframe.

COT Report

COT reports for the British pound show that commercial traders' sentiment has been changing constantly in recent years. The red and blue lines representing the net positions of commercial and non-commercial traders frequently cross each other and are mostly near the zero mark. Currently, they are at almost the same level, indicating approximately equal amounts of long and short positions.

The dollar continues to decline due to Donald Trump's policies, so market makers' demand for sterling is not particularly significant at the moment. The trade war will continue in one form or another for a long time. The Fed will, in any case, lower rates in the coming year, leading to a decline in dollar demand in one way or another. According to the latest report (dated September 23) on the British pound, the "Non-commercial" group opened 3,700 BUY contracts and closed 900 SELL contracts. Thus, the net position of non-commercial traders increased by 4,600 contracts over the week. However, this data is already outdated, and there are no new reports.

In 2025, the pound rose significantly, but one must understand that this was due to Donald Trump's policies. Once this reason is mitigated, the dollar may begin to rise, but when this will happen is anyone's guess. It does not matter how fast the net position for the pound is increasing or decreasing. The net position for the dollar is declining in any case, and it is generally declining faster.

GBP/USD Analysis on 1H

On the hourly timeframe, the GBP/USD pair has finally broken the trend line and surpassed the Senkou Span B line. Therefore, in the coming weeks, we can expect the British pound to continue its growth. To further complicate matters for traders, the market may begin a corrective downward pullback before resuming growth slightly later. The dollar still lacks global reasons to strengthen, so we expect the pair to resume growth toward the 2025 highs in almost any case. We believe that the upward movement will continue in the medium term, regardless of local macroeconomic and fundamental backgrounds.

For November 14, we highlight the following important levels: 1.2863, 1.2981-1.2987, 1.3050, 1.3096-1.3115, 1.3212, 1.3307, 1.3369-1.3377, 1.3420, 1.3533-1.3548, 1.3584. The Senkou Span B line (1.3190) and the Kijun-sen line (1.3144) may also serve as sources for signals. It is recommended to set the stop-loss order to breakeven if the price moves in the right direction by 20 pips. The Ichimoku indicator lines may shift throughout the day, which should be considered when determining trading signals.

On Friday, no significant or interesting events are scheduled for the UK or the US. Thus, trading during the day will need to be based solely on technical factors.

Trading Recommendations:

Today, traders may consider short positions if the price rebounds from the 1.3212 level or settles below the Senkou Span B line, with a target at 1.3144. However, we would advise caution with selling at this time. Long positions are much more relevant if the price consolidates above 1.3212, targeting 1.3307.

Explanations for Illustrations:

- Support and resistance price levels are shown as thick red lines, near which the movement may end. They are not sources of trading signals.

- Kijun-sen and Senkou Span B lines are lines from the Ichimoku indicator transferred to the hourly timeframe from the 4-hour timeframe. They are strong lines.

- Extreme levels are thin red lines from which the price previously bounced. They are sources of trading signals.

- Yellow lines are trend lines, trend channels, and any other technical patterns.

- Indicator 1 on COT charts represents the size of each category of traders' net position.