The GBP/USD currency pair also slightly rebounded on Monday after a three-day drop. Regarding the euro, we previously mentioned that a minor decline (and 150 points is considered minor) should not shock traders. Not every move in the currency market can be logically explained, and not every move even needs explaining. That's why technical analysis exists — it visualizes what's happening in the market and helps answer the question: "What should we expect next?" If every price movement could be explained fundamentally or macroeconomically, there would be no need for technical analysis.

Now, we've already discussed the political crisis in France and previously addressed the UK's budget issues. So now let's focus on the threat of a new U.S. government shutdown. Let's recall that the threat of a shutdown in America is about as routine as a favorite football team's match. Once a year (or even more often), Democrats and Republicans fail to agree on a funding bill for a specified period or can't reach consensus on raising the debt ceiling. Shutdowns occurred multiple times during Donald Trump's presidency.

A shutdown is the forced suspension of certain government functions due to a lack of funding. Until Congress and the President pass a law approving funding for a specific period, financing for all governmental institutions is paused. Of course, not every government agency can be shut down, but many cease operations.

Naturally, the issue always comes down to money. Currently, Republicans hold power, but to pass a funding bill in the Senate, at least 7 Democratic votes are needed since 60 out of 100 votes are required to pass such legislation. Republicans hold only 53 Senate seats. That's enough to pass most decisions by simple majority, without consulting Democrats. However, budget funding laws require 60 votes — not just 50% + 1.

Donald Trump, of course, blamed the potential shutdown on the Democrats, calling all of them crazy. The U.S. President is starting to sound like a broken record — almost anyone with a differing opinion is, in his words, insane. Democrats are demanding the preservation of healthcare subsidies and the restoration of Medicaid funding. Republicans disagree.

Therefore, extended and difficult negotiations between the two ruling parties will begin soon, as Democrats still have the leverage to stall things for Republicans. However, we can be fairly certain that at some point, both sides will reach a compromise. The only question is — when? The threat of a shutdown carries no positive implications for the national currency. The same is true for political crises or budget problems. For this reason, we do not believe the dollar currently holds a significant advantage over the euro or pound.

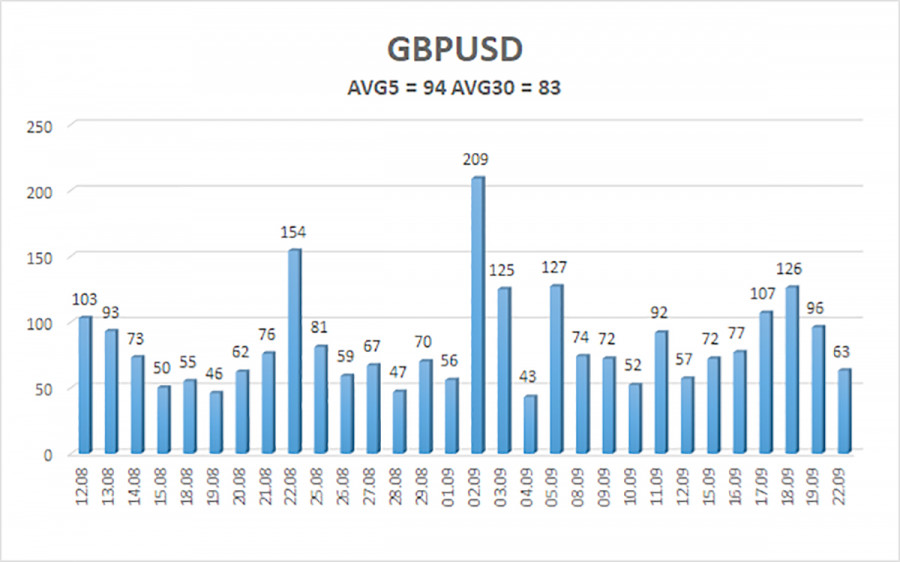

The average volatility of the GBP/USD pair over the last 5 trading days is 94 points. For the pound/dollar pair, this is considered "average." On Tuesday, September 23, we expect movement within the range bounded by levels 1.3408 and 1.3596. The senior linear regression channel points upward, indicating a clear upward trend. The CCI indicator has once again moved into oversold territory, which serves as another signal of resumed upward momentum.

Nearest support levels:

- S1 – 1.3428

- S2 – 1.3367

- S3 – 1.3306

Nearest resistance levels:

- R1 – 1.3489

- R2 – 1.3550

- R3 – 1.3611

Trading Recommendations:

The GBP/USD currency pair is once again undergoing a correction, but its long-term outlook remains unchanged. Donald Trump's policies continue to pressure the dollar; therefore, we do not expect any significant growth from the American currency. Accordingly, long positions with targets at 1.3672 and 1.3733 remain much more relevant if the price is above the moving average line. When the price is below the moving average, small short positions may be considered on purely technical grounds. From time to time the dollar shows corrective movements (as it's doing now), but for a trend-based strengthening, it will need real signs like the end of the global trade war or other major positive factors.

Explanation of illustrations:

- Linear regression channels help determine the current trend. If both channels point in the same direction, the trend is strong.

- The moving average line (settings: 20,0, smoothed) identifies the short-term trend and direction in which trading should currently be conducted.

- Murray levels are target levels for price movements and corrections.

- Volatility levels (red lines) represent the likely price channel in which the pair will trade over the next 24 hours based on current volatility indicators.

- The CCI indicator — when it enters the oversold area (below -250) or overbought area (above +250) — signals that a trend reversal in the opposite direction may be approaching.