Trade Review and Trading Tips for the European Currency

Due to low market volatility in the first half of the day, the price never reached the levels I had identified. As a result, I ended the session without any trades.

The fact that actual inflation figures in Germany and Italy matched expert expectations did not cause any fluctuations in the EUR/USD exchange rate during the first half of the day. Later, after a short pause, financial markets will once again enter a phase of intense activity. The focus will be on key U.S. macroeconomic data and statements from Federal Reserve officials, which could significantly influence market sentiment.

First of all, data on changes in industrial production volumes will be released. This indicator is important for assessing the state of the economy. An increase in industrial production signals stronger economic activity, rising consumption, and a favorable environment. A decline, on the other hand, may indicate slowing growth, difficulties in certain sectors, or broader negative economic trends. Equally important will be speeches by FOMC members Michelle Bowman and Philip N. Jefferson. Traders this week are paying close attention to remarks from Fed officials, hoping to hear signs of possible changes in the Fed's monetary policy. Their comments on the current economic situation, inflation outlook, and plans for further interest rate management could have a significant impact on the U.S. dollar.

As for the intraday strategy, I will rely primarily on the implementation of Scenarios No. 1 and No. 2.

Buy Signal

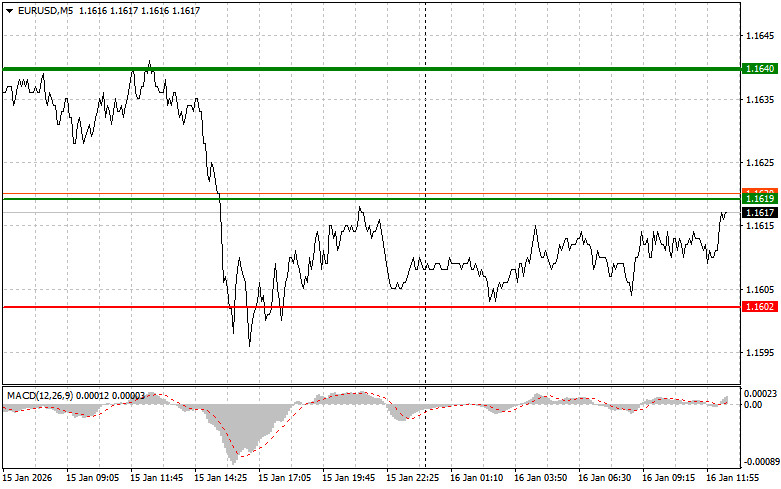

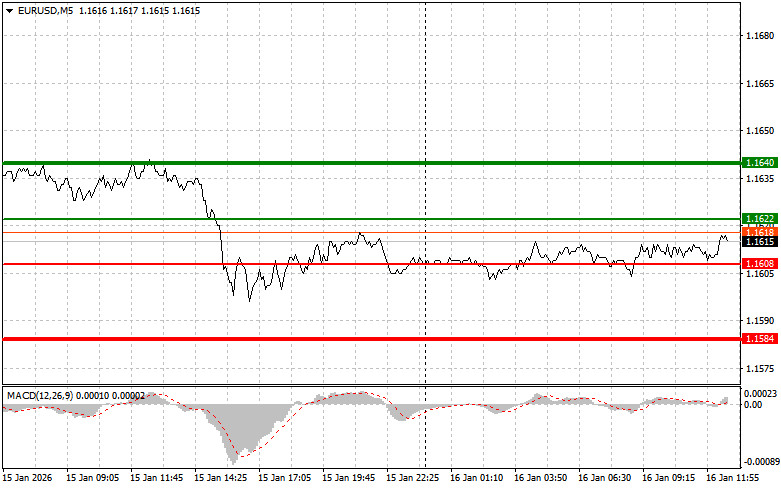

Scenario No. 1: Today, buying the euro is possible when the price reaches the level around 1.1622 (green line on the chart), with a target of growth toward the 1.1640 level. At 1.1640, I plan to exit the market and also sell the euro in the opposite direction, aiming for a move of 30–35 points from the entry point. Strong euro growth can be expected after weak U.S. data.Important! Before buying, make sure that the MACD indicator is above the zero line and is just starting to rise from it.

Scenario No. 2: I also plan to buy the euro today in the event of two consecutive tests of the 1.1608 level while the MACD indicator is in oversold territory. This would limit the pair's downward potential and lead to a bullish market reversal. A rise toward the opposite levels of 1.1622 and 1.1640 can be expected.

Sell Signal

Scenario No. 1: I plan to sell the euro after the price reaches the 1.1608 level (red line on the chart). The target will be the 1.1584 level, where I plan to exit the market and immediately buy in the opposite direction (aiming for a move of 20–25 points in the opposite direction from that level). Pressure on the pair will return if Fed officials take a hawkish stance.Important! Before selling, make sure that the MACD indicator is below the zero line and is just starting to decline from it.

Scenario No. 2: I also plan to sell the euro today in the event of two consecutive tests of the 1.1622 level while the MACD indicator is in overbought territory. This would limit the pair's upward potential and lead to a bearish market reversal. A decline toward the opposite levels of 1.1608 and 1.1584 can be expected.

What's on the Chart:

- Thin green line – entry price at which the trading instrument can be bought;

- Thick green line – estimated price where Take Profit can be placed or profits can be taken manually, as further growth above this level is unlikely;

- Thin red line – entry price at which the trading instrument can be sold;

- Thick red line – estimated price where Take Profit can be placed or profits can be taken manually, as further decline below this level is unlikely;

- MACD indicator – when entering the market, it is important to rely on overbought and oversold zones.

Important. Beginner Forex traders must be extremely cautious when making market entry decisions. Before the release of major fundamental reports, it is best to stay out of the market to avoid sharp price fluctuations. If you decide to trade during news releases, always place stop-loss orders to minimize losses. Without stop-loss orders, you can very quickly lose your entire deposit—especially if you do not use proper money management and trade large volumes.

And remember that successful trading requires a clear trading plan, like the one presented above. Spontaneous trading decisions based on the current market situation are an inherently losing strategy for an intraday trader.